Why PAYE Matters - Protecting Your Business from Hidden Staffing Risks

The Hidden Risks in Your Staffing Strategy: Are You Unknowingly Exposed?

In hospitality, where every service moment counts and margins are tight, recruitment compliance rarely makes it to the top of your priority list. Yet this seemingly mundane aspect of operations could be the difference between sustainable growth and facing unexpected legal battles that threaten your business’s future.

The uncomfortable truth is that many hospitality leaders place blind trust in their recruitment partners, assuming compliance is handled properly behind the scenes. When HMRC investigators arrive at your door, however, that trust will not shield you from liability. Your business becomes accountable for the employment practices of every agency worker on your premises, regardless of who hired them.

This reality has caught many successful hospitality operators off guard, resulting in backdated tax demands, employment tribunal claims, and reputational damage that takes years to repair. The question is not whether you trust your recruiter, it is whether their practices can withstand regulatory scrutiny when your business is on the line.

Understanding PAYE: The Foundation of Compliant Employment

PAYE represents more than just a tax collection mechanism, it is the legal framework that protects both workers and businesses from the complexities of employment law. Under this system, income tax and National Insurance contributions are automatically deducted from employee wages, while employers fulfil their obligations regarding holiday pay, pension contributions, and statutory entitlements.

When recruitment agencies operate within this framework, workers receive proper payslips, legal protections, and the employment rights they are entitled to. More importantly for your business, this approach creates clear audit trails and ensures regulatory compliance at every level.

The challenge emerges when agencies attempt to minimise their own costs and liabilities by circumventing these established processes. Some recruiters push payroll responsibilities onto umbrella companies or misclassify workers as self-employed contractors, even when these individuals clearly function as employees under legal definitions.

While these arrangements might appear to offer cost savings or administrative simplicity, they fundamentally shift compliance risks away from the agency and directly onto your business. When regulatory authorities investigate these structures, it is your company that faces the consequences of non-compliance, regardless of who initially created the problematic arrangement.

The True Cost of Non-Compliance: Beyond Financial Penalties

The financial implications of recruitment compliance failures extend far beyond the immediate penalties that capture most attention. HMRC’s backdated tax assessments can stretch years into the past, creating substantial unexpected liabilities that strain cash flow and operational budgets.

Employment tribunals represent another significant risk area. When agency workers discover they have not received proper holiday pay, pension contributions, or other statutory entitlements, they often pursue claims against the end client, your business, rather than the recruiting agency. These cases can result in substantial settlements and create precedents that encourage additional claims from other workers.

The Off-Payroll Working Rules, commonly known as IR35, add another layer of complexity. If HMRC determines that workers classified as contractors should have been treated as employees, your business could face penalties for failing to operate PAYE correctly, even if the misclassification originated with your recruitment partner.

Perhaps most damaging in our connected world is the reputational impact of compliance failures. Regulatory investigations often become public record, and businesses found to have participated in non-compliant employment practices may find themselves subject to media scrutiny and public criticism. In an industry where brand reputation directly impacts customer loyalty and employee attraction, these consequences can prove more costly than any financial penalty.

The Criminal Finances Act adds the most serious dimension to these risks. Businesses that benefit from tax evasion schemes, even unknowingly, can face criminal charges and unlimited fines. While most recruitment compliance issues do not reach this level, the legislation demonstrates how seriously authorities treat employment tax matters.

Evaluating Your Current Risk Exposure

Most hospitality leaders discover compliance gaps only after problems emerge, but proactive assessment can identify issues before they escalate into serious problems. The key lies in understanding how your recruitment partners actually operate, rather than relying on their assurances that everything is handled properly.

Direct PAYE employment represents the gold standard for compliance. When agencies employ workers directly and operate their own payroll systems, they maintain full control over tax deductions, holiday pay calculations, and statutory contributions. This approach creates clear responsibilities and reduces the likelihood of regulatory challenges.

Umbrella company arrangements require more careful scrutiny. While some legitimate umbrella companies operate compliantly, others use these structures to minimise costs in ways that create risks for end clients. The key distinction lies in whether workers receive their full employment rights and whether tax obligations are handled transparently.

Self-employment classifications demand the highest level of attention. Genuine self-employment involves workers controlling how, when, and where they perform their duties, providing their own equipment, and bearing financial risk for their work quality. In hospitality, where workers typically follow set schedules, use company equipment, and perform standardised tasks under direct supervision, genuine self-employment is relatively rare.

Your recruitment partner’s willingness to discuss these arrangements openly often indicates their compliance confidence. Agencies that become defensive or vague when asked about their employment models may be using structures they are not entirely comfortable defending to regulatory authorities.

Building Compliance Into Your Procurement Process

Effective compliance management begins during the recruitment partner selection process, not after problems emerge. This requires developing specific questions and verification procedures that reveal how potential partners actually operate, beyond their marketing claims.

Request detailed explanations of their payroll processes, including how they calculate and remit taxes, handle holiday pay entitlements, and manage pension contributions. Compliant agencies welcome these discussions because they demonstrate their commitment to proper employment practices.

Verify their PAYE registration status and request recent evidence of their tax compliance. This might include confirmation from their accountants or evidence of their recent filings with HMRC. Agencies operating compliantly maintain transparent records and readily provide this information.

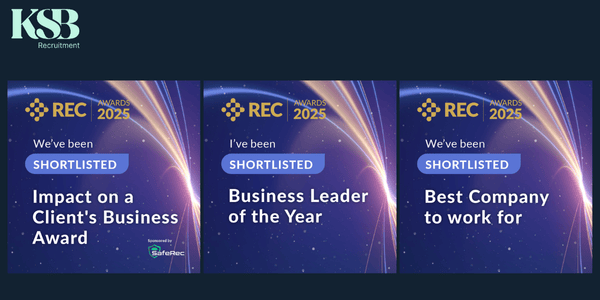

Examine their accreditation status with recognised industry bodies such as the Recruitment and Employment Confederation. While accreditation does not guarantee compliance, it indicates commitment to industry standards and provides additional oversight of their practices.

Review their standard contracts and worker documentation. Look for clear employment terms, proper payslip formats, and evidence of statutory entitlements. These documents reveal whether the agency treats workers as genuine employees or attempts to minimise their obligations through creative contract structures.

The Strategic Advantage of Compliant Partnerships

Working exclusively with compliant recruitment partners offers benefits that extend beyond risk mitigation. These agencies typically attract higher-quality workers because they offer better employment conditions, including proper holiday pay, pension contributions, and job security.

Compliant agencies also tend to invest more heavily in worker training and development, recognising that their employment model depends on maintaining long-term relationships rather than minimising short-term costs. This approach often results in more skilled, motivated workers who contribute more effectively to your operational objectives.

From a strategic planning perspective, compliant partnerships provide predictable costs and transparent processes that support accurate budgeting and financial forecasting. You avoid the uncertainty and potential liabilities associated with non-compliant arrangements, enabling more confident business planning.

Perhaps most importantly, compliant recruitment partnerships align with the broader trend toward responsible business practices that increasingly influence customer preferences, employee attraction, and investor decisions. Demonstrating commitment to fair employment practices through your supply chain choices strengthens your overall brand positioning.

Taking Action: Protecting Your Business Today

If this analysis has raised concerns about your current recruitment arrangements, you are not alone. Many successful hospitality operators have discovered compliance gaps that require immediate attention, and addressing these issues proactively almost always proves less costly than waiting for regulatory intervention.

Begin by conducting honest assessments of your existing recruitment partnerships. Document how workers are actually employed, paid, and treated, rather than relying on contractual descriptions that may not reflect operational reality. This assessment should focus on substance over form, what actually happens matters more than what agreements claim happens.

Engage directly with your recruitment partners about compliance matters. Ask specific questions about their employment models and request documentary evidence of their practices. Their responses will quickly reveal whether they operate with the transparency and confidence that characterises compliant providers.

Consider obtaining independent compliance reviews of your recruitment arrangements. Employment law specialists can identify risks that may not be apparent to operational managers and provide specific recommendations for addressing any issues discovered.

The hospitality industry’s recovery requires sustainable staffing solutions built on solid compliance foundations. While addressing these issues requires investment of time and attention, the alternative of facing regulatory action while trying to manage complex operational challenges poses far greater risks to your business’s success and reputation.

Your staffing strategy shapes every aspect of your guest experience and operational effectiveness. Ensuring that this strategy operates within proper legal frameworks is not just about compliance, it is about building the reliable, sustainable workforce that enables long-term success in an increasingly competitive market.

Not Sure Where You Stand?

If reading this raised questions about your current setup you are not alone. Many hospitality operators assume their recruiter is handling everything, only to discover gaps later on.

We are not here to scare you. We are here to help you stay protected, informed, and confident in your staffing choices.

If you would like a second opinion on your current agency arrangement or a free checklist you can share with your internal team get in touch with us. We are happy to walk you through it.